Publications

Labor Issues Strike Overseas Supply Chains

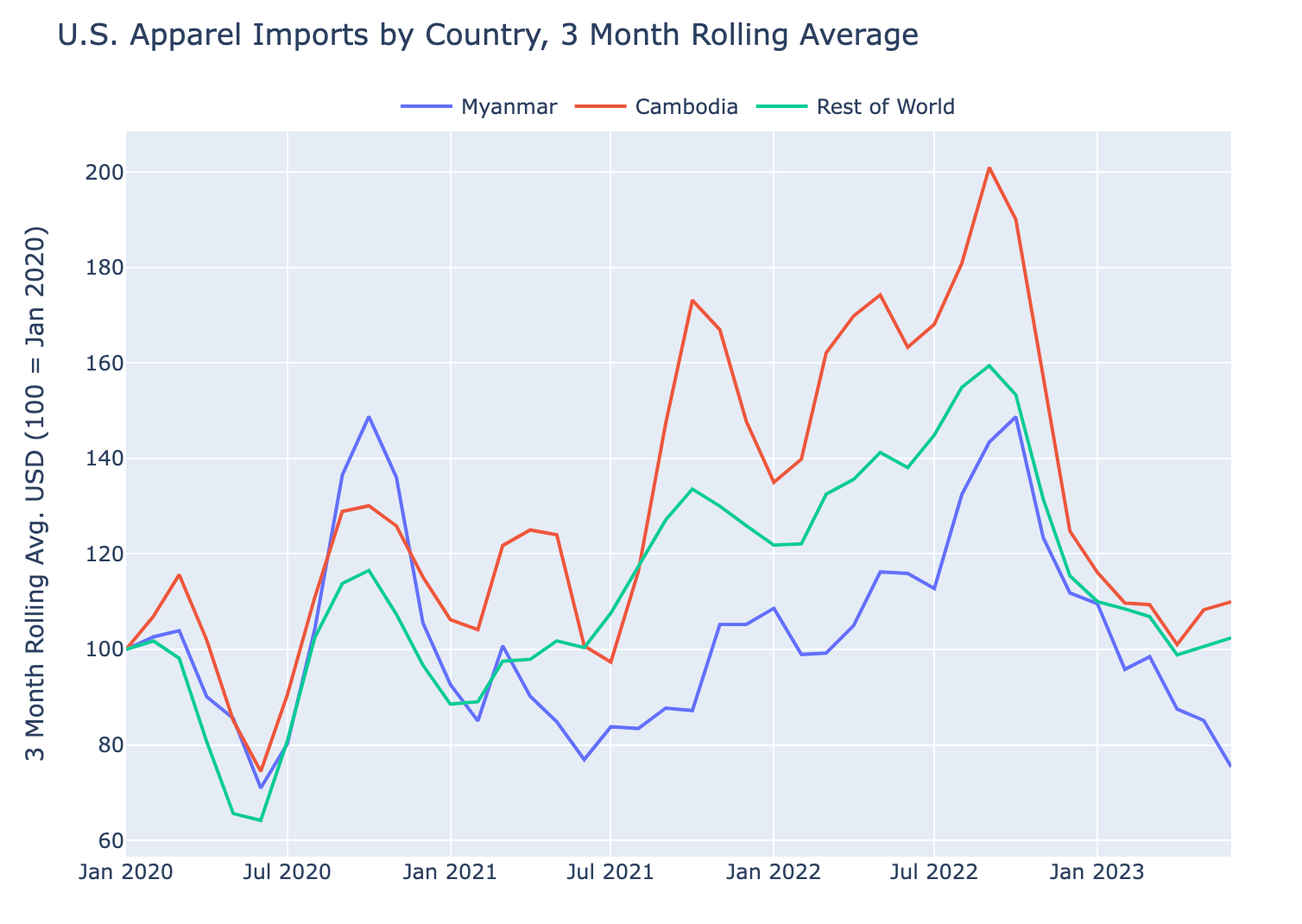

Allegations of forced labor have surfaced in two different supply chains - apparel and solar.

Rail’s Getting in the Way - Inland U.S. Congestion Issues

U.S. rail networks have entered a new period of congestion even as carloads carried have fallen and the freight demand outlook darkens. Employment in rail has not recovered after the pandemic and has lagged the development of volumes over the past 18 months.

Steel Yourself For CBAM: Legislation Moves Forward, Coverage Expanded

How close is the EU to implementing its carbon border tax? What products are being covered? This report builds on earlier research and finds that the greatly expanded scope of the CBAM now accounts for over 11% of EU imports compared to 5% previously after the inclusion of more chemicals and plastics.

Short vs. Quick - Comparing U.S. Coastal Port Performance

Is the shortest path the fastest? Trends in Ocean shipping show that may not always be the case. This report reviews data comparing shipping and turnaround times between East and Gulf Coast versus West Coast ports. East and Gulf Coast ports, while more numerous and smaller than their Pacific peers, are capturing more and more of U.S. imports after a brief pandemic reversal.

Steel Yourself for CBAM - The Way Ahead

The EU is committed to implementing the Carbon Border Adjustment Mechanism (CBAM). How will companies be affected? What hurdles does implementation face? This is the second of a series of reports looking at CBAM’s potential impact on global supply chains. It focuses on the basics behind CBAM and general challenges faced by the corporations involved.

Steel Yourself for CBAM - Climate Regulations for Trade

The EU is committed to implementing the Carbon Border Adjustment Mechanism (CBAM). What are its aims? Which products will be covered? How will trade be affected? When will it come into force? This is the first of a series of reports looking at CBAM’s potential impact on global supply chains.It focuses on the basics behind CBAM and general challenges faced by the corporations involved.

Uphill Struggle, Downhill Stretch - Trucking’s Price Paradox

The cost of trucking has hit a record yet there are concerns in the industry about the future. What’s led to the higher prices? Why might they fall? Is this a leading indicator for logistics more broadly? This report looks at a series of open source indicators for the trucking sector and finds a downturn could be nigh.

Panjiva 2022 Outlook: At the tipping point

2021’s unprecedented year for global trade sets a high bar — for better or for worse — for 2022. Companies and governments will be looking closely at international trade as both a solution and a problem, depending on the issue, and may be considering some of the scenarios presented in this report.

Q4’21 Outlook: The logistics of seasonal cheer

The fourth quarter of 2021 will likely look different than the holiday seasons in previous years. This is largely due to the ongoing high-water mark of imports flowing into the U.S. since March. Imports in March were the highest recorded, an unlikely time for volumes that normally peak in October.

Branching Out: Graph Theory Fundamentals

Investment analysis has evolved beyond financial data to non-financial, or alternative data. Typically, the focus has been on using alternative datasets that are purely time-series and tabular, which is suited to stock selection models. Graph networks meanwhile offer investors the ability to gain deeper insights into the connections between economies, industries, and individual corporations. Examples of networks include corporate stock holdings, analysts’ stock coverage, management board memberships, political relationships, common patents, and supply chains.

GameStop gears up ahead of Xbox holiday cheer

Videogame retailer Gamestop reported a 30.2% year over year slide in revenues for FQ3’21. That contrasts with a 34.0% year over year increase in U.S. seaborne imports linked to the firm which likely reflects an earlier-than-normal seasonal increase in shipments.

Cold Turkey: Navigating Guidance Withdrawal with Supply Chain Data

A recent surge in corporate earnings guidance withdrawals has left decision-makers missing a wrench in their toolbox. Corporate guidance was already declining, in 2018, the number of companies in the Russell 3000 providing guidance peaked at 1,721, dropping 6.9% year over year in 2019 to 1,632 companies. Guidance has been further impacted by the Coronavirus pandemic, as 173 companies withdrew their previous guidance in the first quarter (Figure 1). This leaves decision-makers looking for alternative forward-looking information on a company’s prospects.

Long Road to Recovery: Coronavirus Lessons from Supply Chain and Financial Data

COVID-19 continues to disrupt global supply chains in unprecedented ways. Leveraging maritime shipping data from Panjiva, this report includes a review of trade and financial data to analyze the impact of the SARS-CoV-2 / COVID-19 coronavirus outbreak.